Anyuta Research and Development

Our years of investment in the Research and Development in the field of Healthcare Financing, Delivery System, Documentation and Accounting, resulted in a win – win situation for the Healthcare Financiers, Healthcare Provider Network and the Policyholders. Our research and field trial was conducted in stages with different insurance products and in different states.

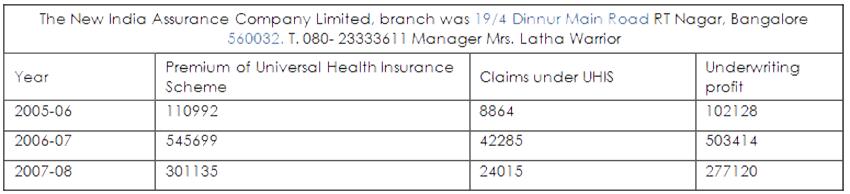

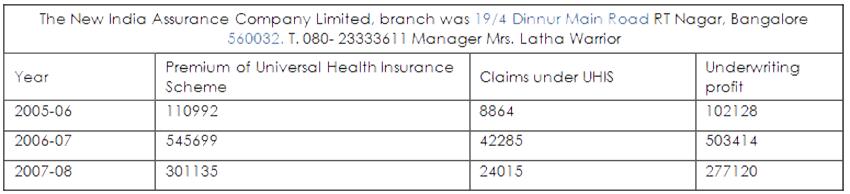

Stage 1- State of Karnataka - UHIS

For the R&D work, we selected one Public Sector Company, The New India Assurance Company Limited , one healthcare Product, Universal Health Insurance Scheme (UHIS), dedicated Network of Hospitals and a group of dedicated doctors, practicing ethical medicine. This resulted in a Health care System, with inbuilt checks and balances, creating a marginal surplus to all the stakeholders and giving the best of healthcare to the Policyholder.

The result

This is a clear indication that the insurer can generate marginal revenue surplus even in a government sponsored, highly subsidized social, security health scheme like UHIS.

Stage II - State of Rajasthan

We then took our researched product to the State of Rajasthan and used it.

A. Insurer : Rajasthan State Insurance and Provident Department

B. The coverage is for,

- The entire State Government employees and their families.

- Cover in the first year was for one lakh on a floater basis.

- Cover in the second year was for two lakhs.

Our associate company, Anyuta TPA in Health Care provided the TPA services for three years.

Result

- The very first year the RSI&PF Department`s revenue out flow in claim settlement was reduced by nearly half of the previous year, saving in lakhs of rupees.

- The pattern continued with the system getting better and better, inbuilt checks and balances.

Process

- The RSI&PF Department empanel hospitals (Government and Private)

- The Policyholder had the options of either taking cashless facility or getting reimbursement.

- The TPA in Health care, issue authorization letters, process the claims, prepare the float and submit it to RSI&PF Department

- The TPA generate Health Cards

- The TPA was paid for the TPA services and Card fee

The RSI&PF Department on its part,

- Scrutinize the float submitted by the TPA for authenticity,

- Send the scrutinized float to the State Treasury

- Release funds from the Treasury against the individual in the Float raised,

- Deposit the total float amount cheque in the TPA`s account

The TPA on its part

- Disburse the amount to the Claimant by way of banking instruments only.

- Submit the Bank Statements to the RSI&PF to tally and release next float amount

All was not well in the above process and use to bleed the Insurer before we arrived

- We noticed the flows in the system and it was open for the Insurance bureaucrats, TPA, Hospital and the policyholder to collude to bleed the Insurer.

- There were no checks and balances at all and the managerial costs were high

Hospitals

- There were cases of over stay in the hospitals, over billing, over medication, unnecessary investigations and surgeries etc.

- The Implants, Stents, Medical and Surgical Bills were pretty high

- The Surgery procedure was split into sub headings and billed separately

Insurance bureaucrats were not,

- collecting the Original claim files along with the Process Sheet, when the Float was submitted

- Tallying the Bank Statements with the Float amount released by the Treasury before releasing the next float amount.

- answering the TPA queries regarding Policy conditions

- Settling the Claims directly and thus duplicating work for themselves as well as the TPA

We gave our inputs to RSI&PF Department to better the services

Anyuta advised RSI&PF to,

- Redraft the Policy conditions with CGHS Rate being the basis of Claim Settlement

- Directly settle the claims by depositing the amount in the Policyholder`s Bank Account

- Issue Biometric Health Card that does not require renewal and can be used by the hospitals for identification.

- Collect the Processed Files along with Claim Floats submitted

- Collect all files that are repudiated along with the Process Sheet showing reasons

- Decide on the repudiated cases within a week

- Maintain a registers to document the receipt of the Claim Files, Processed files, Repudiated files,

- Digitalize the system and put it out in the website for people to know the process

Result

- The system changed, checks and balances crept in, Insurer saved on revenue out flow and is confident of success on additional business.

- The RSI&PF Department is now ready to provide a cover of 3 lakhs at a Premium less than Rs.1500/- per family of 5, and cover the entire State population and still generate marginal surplus.

- Ready to implement “Right to Health” as guaranteed under Article 47 of Indian Constitution.

Stage III – State of Odisha - RSBY

The RSBY is a variant of UHIS and the sum insured is Rs.30000/- on floater basis. It is cashless, paperless and electronically managed. This has multiple layers of management (Ministry of Labour and Employment, Government of India, ITGI Head Office, ITGI Bhubaneswar Office, DLC, and TPA) adding costs and confusion.

We serviced 5 naxal infested districts of Odisha State, like, Rayagada, Malkangiri, Kendrapada, Balasore and Koratput, as TPA in health care. The Ifco –Tokio was the insurer and its office at Bhubaneswar was handling the operations.

We noticed that the over enthusiastic Insurance bureaucrats

- Did not realize that the RSBY was introduced by the government to provide quality health care to the poor and is not a business venture to profit

- Were always suspicious of the hospitals without realizing that they cannot interfere in treatment part and the doctors are governed by health laws & MCI

- Did not realize that these hospitals are functioning in the rural areas in difficult conditions with minimal equipment and not so skilled manpower

- Did not realize that the insurer and the scheme managers directly put pressure on the hospitals and the doctors by making them sign to treat patients on fixed rates

- Because of the agreements and putting pressure on the hospitals, have a vicariously responsibility for negligence in the case of doctors cutting corners and underperforming as against the safety norms.

- Introduced a number of formats repeating work done without realizing that the health care is all about putting “Care before Cost” and not statistics to impress the bosses.

- Safety of the patient is of paramount importance while treating the ill and injured and the costs can vary based on the complications that arise and the type of illness one has.

- Stopped payments to hospitals on the pretext that they noticed Moral Hazards on the part of the hospitals and conducted verifications raids on private as well as government hospitals, adding operational costs, only to find things in order and released the money humbly.

Result

- Generated marginal revenue surplus in such low cost schemes in spite of flip flops in chasing Moral Hazards.

- Realized that the doctors and the hospitals have to follow all the safety norms and work with in the frameworks of health laws. In rural areas the terrain, working conditions are different.

- Realized that the doctors do not have the comforts and safety of city practice.

- Realized that the health care costs can vary based on the way the patient reacts and responds to treatment.

- Realized that they can increase the revenue generation by leaving the doctor based TPA to handle Moral Hazard.

Stage IV – Pan India - Anyuta Insurance driven health care - Touching heart

Time has come for the State governments to touch the hearts of every citizen of the state, by providing a health cover of Rs.300, 000/- (rupees three lakhs) per family of 5 members, per year, at a premium of Rs.1500/- (rupees one thousand and five hundred) or less on a floater basis, irrespective of the financial status of the family. This is what the people want and this is what they should get as part of good governance.

In fact there is a pot of gold at the bottom of India`s economic pyramid and not at the end of the rainbow. We are nearly 1.3 billion people with a large percentage forming the bottom of the pyramid.

Hence, India can provide an insurance driven health care at a low premium to cover all. We can and should float our pyramid so that the people at the bottom of the pyramid will reach a level higher for better living conditions. With this India not only become healthier, but also steam forward, to take on the world in all spheres.

The people and the government know that this is a viable and sustainable model. Let us make it a reality and wean the people depending on the government helps each time.

“There's nothing more powerful, than an idea whose time has come" Victor Hugo